Simplifying Financial Confusion

LEARN CASH FLOW HACKING TO REACH FINANCIAL FREEDOM

Used by 90% of millionaires to reach their financial goals 4x faster

Achieve Financial Freedom Through Cash Flow Hacking

Increase Your Lifestyle While You Build Your Wealth

Position Yourself to Thrive in Market Downturn

YOU SHOULD NOT FEEL OUT OF CONTROL ABOUT YOUR FINANCIAL STRATEGY

Have easy access to your money in case of emergencies and opportunities

Use the investment strategy 90% of millionaires use

You deserve a clear plan to consistently grow your money and avoid market uncertainty

Have a guide and advisor that has your best interest in mind

Do not overpay in taxes

Stop guessing at the best vehicles to protect and grow your money

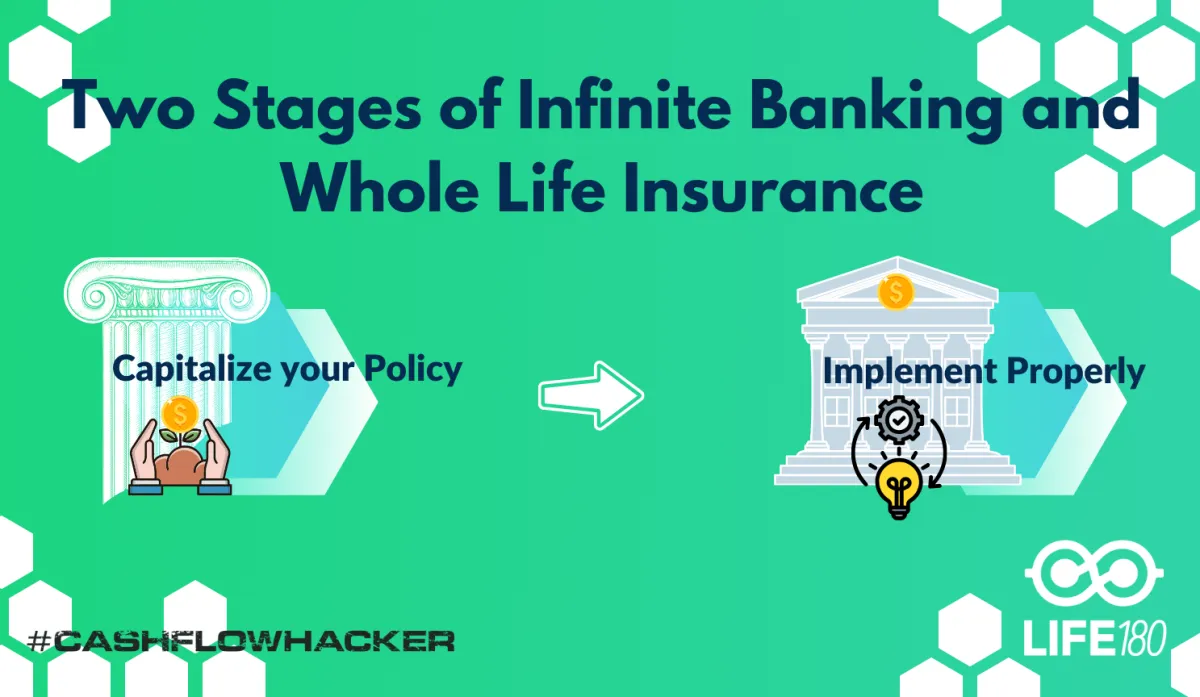

Two Stages of Infinite Banking and Whole Life Insurance

Discover the full transcript of our insightful video, available exclusively on the LIFE180 YouTube channel.

If you follow my content, you'll know that I often discuss topics like infinite banking, whole life insurance, and personal finance in general. When it comes to infinite banking, a quick glance across various social media platforms reveals a significant amount of conversation surrounding the concept of "positive arbitrage", often dubbed as the "unsung hero of infinite banking." This is where many people tend to become perplexed about the essence of infinite banking.

I strongly advocate for the strategic use of well-designed whole life insurance for the purposes frequently discussed in the context of infinite banking. To clarify this concept, I will simplify the discussion surrounding whole life insurance.

Let's delve into the two distinct stages you must consider when contemplating the incorporation of whole life insurance into your financial strategy to elevate your personal finances. The ultimate goal is to enhance the efficiency of every financial decision you make, as this is the essence of assuming control over the banking aspect of your life.

Many individuals assume that they can immediately start banking with their policy, but the reality is quite different. I will guide you through the two initial stages where most people commence, what steps are required to reach your ultimate goals, and begin earning positive arbitrage. Additionally, we will explore the various variables within the policy and the considerations involved in its construction.

I am here in the Dominican Republic. I'm gonna be working down here for the next three weeks doing my content from here. You're probably gonna get a completely different vibe while I'm down here checking out our investment properties, I'm doing a lot of really fun things happening down here. We got a couple houses, investment properties that we're getting completed in the next three weeks or so. A lot of really positive things are happening.

I've been inspired to talk about infinite banking. I was inspired through a conversation that I was having with a professional colleague. This discussion brought to light how infinite banking is often misrepresented in the marketplace. Many social media influencers tend to mislead individuals by making claims about achieving positive arbitrage with their banking policies.

One crucial aspect to grasp, and where I'd like to begin, is taking a step back and considering the purpose. If, for instance, I were engaging in this conversation with you for the first time, my initial query wouldn't be whether you require an infinite banking policy or how you plan to integrate it into your life. I strongly believe in aligning your financial decisions with your values and beliefs. It's essential to understand that infinite banking isn't suitable for everyone because not everyone will utilize the policy correctly.

This leads me to encourage people to ponder: Do I genuinely require an emergency fund? Most individuals would likely answer affirmatively, acknowledging the necessity of such a fund. Because here's a reality check – if you don't believe an emergency fund is necessary, you might find yourself in significant turmoil at some point in your life. It's crucial to be equipped to navigate the fluctuations in our world, the economy, market cycles, and various other factors. Furthermore, it's not just about safeguarding yourself; it's about being ready to seize opportunities when they arise in these dynamic environments.

Next, I'll inquire about the size of the emergency fund you think is necessary. Most likely, you'll respond with six months, as this is a common belief in the realm of personal finance. Influential figures like Art Williams, Dave Ramsey, and Suzy Orman have advocated for this rule of thumb. However, I firmly believe we should dig deeper and ask 'why.' Why is it six months? When I delve into the statistics and examine the average duration it takes to secure a new job, it typically equates to one month for every $10,000 of income earned. For instance, if your annual income is $60,000, an emergency fund capable of covering six months of expenses aligns with this rule, as $60,000 divided by $10,000 equals six months.

While the average might support a six-month emergency fund, I'm a firm believer in aiming higher than average. I don't want to be merely prepared for the average situation; I want to be prepared for more than the average. That's why I encourage you to consider various factors. I don't subscribe to one-size-fits-all solutions like 'you need six months of expenses' or 'you need ten months of savings.' Such cookie-cutter advice is too simplistic and won't necessarily help you achieve your financial goals or align your money with your values and beliefs.

If you believe that having an emergency fund is essential, the next question to address is where to save that money. What's the most effective and efficient place to stash those funds from a long-term perspective?.

As we find ourselves in the first half of 2023, it's important to note that several significant changes have occurred in the past six months, particularly in the realm of life insurance and the fixed market. About a year ago, I could confidently discuss how whole life insurance could outperform a typical savings account. However, the landscape has evolved, and you can now place your money directly into a savings account.

While it may appear that a savings account outperforms a whole life policy in the short term, it's essential to recognize that a whole life policy offers numerous advantages that a savings account lacks. Currently, you might obtain around four to four and a quarter percent within a whole life policy, and over the long term, that rate can increase to four to four and a half percent.

That seems like, why would I put my money in a whole life policy instead of this savings account where it's even more liquid. Besides that in a whole life policy, I'm going to lose about 10% liquidity right out of the gate to implement this and invest in this long-term strategy. Why would I want to do that? It's because of a lot of reasons.

By investing in a whole life policy, you'll receive life insurance coverage, which some people may not necessarily need. However, there are numerous compelling reasons to consider it. One significant advantage is the provision of lifelong living benefits, a crucial aspect that sets it apart from strategies like the 'buy term and invest' approach advocated by financial personalities such as Dave Ramsey, Suze Orman, Art Williams, and Primerica representatives. In contrast, when your term insurance expires, you won't have access to any living benefits. Actually, most term policies don't offer living benefits at all.

Having the ability to access living benefits and tap into your death benefit while you're alive, especially for medical and long-term care needs or in cases of disability, is a key advantage that often goes unnoticed. Consider this scenario: I'm currently in my 40s, and I may not require these benefits right now, nor do I anticipate needing them in the near future. However, it's reasonable to assume that by the time I reach my 60s, 70s, or 80s, there's a good chance I'll need them. This highlights the importance of adopting a long-term perspective. You can't adequately address long-term challenges with a short-term mindset.

Therefore, I would argue that placing your funds in a whole life policy reflects a long-term approach, while a savings account represents a short-term strategy. Although a whole life policy may not offer the same level of short-term liquidity as a savings account, it excels in the long run. It not only outperforms savings accounts historically but also aligns better with prevailing fixed interest rate conditions. Admittedly, the current interest rate environment is somewhat uncertain, with the Federal Reserve's intentions up in the air and various economic uncertainties at play.

I believe that savings accounts are currently experiencing some advantages. However, it's important to consider that the interest rates that banks are required to pay on these savings accounts are also creating challenges for the banks themselves. This is a situation worth noting, as prominent figures like Jamie Dimon have expressed concerns. In fact, he has gone on record stating that he anticipates the failure of 180 banks this year alone. This predicament is primarily attributed to the strains caused by the interest rates banks must pay on these savings accounts.

Now, let's refocus on the subject at hand: whole life insurance and the concept of infinite banking and arbitrage. When does a whole life insurance policy transform into a banking policy? This question is pivotal as we revisit the idea of needing an emergency fund. For the sake of this discussion, let's assume that using a whole life insurance policy is the route we want to take, although I have additional videos that delve much deeper into why this choice might be more advantageous compared to using a traditional savings account.

Let's assume you've made the decision that a whole life policy is where you want to safeguard your emergency fund. Now, when does that whole life policy transition into your infinite banking policy? This is a common point of confusion because many individuals purchase these policies thinking they're instantly acquiring an infinite banking tool they can use right away. However, the reality is, if you want to become an effective banker, your initial task is to build up your bank's capital.

Many people enter into this strategy with the misconception that they'll see immediate results, but the truth is, for most individuals, it takes time to adequately capitalize their bank.

Perhaps you're someone who currently has a substantial sum stashed away in a savings account, be it $40,000, $50,000, $60,000, or even $100,000 to $200,000. There are definite steps you can take to shift that money from your savings account into a whole life policy.

This will involve an annual premium as part of the process. By making these deposits, you'll further capitalize your banking policy. If you have the ability to front-load the policy with a significant sum, you can start utilizing it for infinite banking purposes relatively quickly. This is because you've sufficiently capitalized it and leveraged it.

However, it's essential to recognize that during the initial five to six years of your policy, you won't be generating positive arbitrage. These are the years with the highest fees associated with your policy, and that's a non-negotiable aspect. It requires a long-term perspective.

It's crucial to understand that even in the short term, if you're not witnessing positive arbitrage on a transaction-by-transaction basis, you're actually positioning yourself for long-term positive arbitrage because you won't disrupt the growth of your money within the policy. As you continue to fund and capitalize your policy, over time, the fees associated with it will decrease, and the policy will become more efficient. This is when you can begin to experience positive arbitrage in your policy.

Those are the two distinct stages that you need to comprehend when it comes to your policy. Initially, when you start a policy, it isn't primarily a banking policy; it serves as your emergency fund or an opportunity fund. The role it plays is determined by your life circumstances. Everyone's situation is unique. For example, if you're a nurse with job security, even during economic downturns, you might not need to rely on your emergency fund as much because the risk of job loss is lower. In this case, you might lean more toward an opportunity fund.

But at the end of the day, I don't care what you call it, an opportunity fund, an emergency fund, rainy day fund, whatever, you have this account, you have your bank capitalized, so you've gotta go through that capitalization phase. Once that bank is capitalized, then you're able to implement banking practices.

Now, I'm also a believer, you're not gonna get rich buying depreciating assets. All these people are saying, you can make money on the cars that you buy, that's a lot of smoke and mirrors.

Regarding the idea of making money from buying cars, it's important to clarify that you're not actually making money from the cars themselves. Instead, you're operating more efficiently by recapturing the money that would otherwise be paid to the bank in interest. In essence, it's about making your financial life more efficient, not generating profits directly from the cars.

And so if it comes down to this conclusion of, or this decision of saying, I'm going to buy this car. I'm going to buy this car no matter what. This car is something I want. Maybe for me it's a brand new Ford Bronco. That's my next thing that I want. Or a Rivian or something of that nature. I want to go get this Ford Bronco. If I know I'm gonna get this Bronco anyway, it's actually for my wife. She wants the Bronco, quite frankly.

Absolutely, when you're planning to purchase a vehicle like the Ford Bronco, it's essential to consider the financial implications. Whether you finance it through a bank or pay for it in cash, there are financial trade-offs to weigh. If you pay in cash, you're effectively self-financing the purchase, but you're also forgoing the opportunity to invest that cash elsewhere where it could potentially earn a return. On the other hand, if you finance it through a bank, you'll have the car and the cash available for other investments, but you'll incur interest expenses.

This is where the concept of Infinite Banking or utilizing whole life insurance can come into play. By leveraging a properly designed whole life insurance policy, you can potentially finance such purchases while keeping your cash working for you within the policy, allowing it to continue growing over time. It's all about optimizing your financial decisions to achieve long-term benefits.

So there's an opportunity cost of paying cash. And so I think a concept that everybody needs to understand, we finance everything in our life. We either pay the bank financing or we pay cash for it and lose the opportunity to have that cash grow for us. That is the opportunity cost. That is what I call self-financing. We are now just losing that opportunity. That cash purchase is actually more detrimental in a lot of ways than paying low interest to the bank.

Another approach I often teach is how to explain the concept of infinite banking in a way that a 10-year-old can understand.", and I'll link, check out the video (Infinite Banking Simplified | Explain the IBC To A 10 Year Old), it talks about becoming a wealth creator. If you find yourself in a situation where you can maintain uninterrupted compounding, you'll be paying an interest rate, but your money will continue to grow for you. It's important to note that you won't generate a profit. In the case of purchasing that Bronco, for instance, I won't be making money or earning from it.

However, what I will accomplish is a reduction in the wealth transfer to another institution. I'll maintain control over my money and ensure that I never disrupt the compounding process, which is a fundamental element in wealth creation. The goal is to avoid unnecessary money loss or spending and focus on safeguarding that continuous compounding and reclaiming the money that would otherwise be spent at an external institution. Please note that this doesn't imply making money from the vehicle itself.

In essence, what I'm doing when I spend on that vehicle is executing the most efficient approach possible. I'm recapturing the money that would have otherwise slipped away. You could argue that this is akin to making money on it, but it's a matter of terminology and a bit of wordplay. Personally, I'm not comfortable asserting that you're making money from the purchase of a depreciating asset, and it's an ethical stance that I adhere to. While I understand the buzz and why many are drawn to this approach, after careful consideration, I'm not comfortable with making that assertion.

However, when you reach that point, you hold the reins. You decide how to use that policy. It could be for purchasing vehicles, funding your kids' college education, or employing it for cash flow strategies such as real estate investments. You'll be able to leverage the cash flow to repay policy loans and replenish your policy. These are the considerations you must make once your policy is fully capitalized.

If you haven't yet reached this point and your policy isn't adequately capitalized, understand that achieving this initial stage effectively is crucial to your success. Your financial behavior, your decisions, and your adherence to the principles and filters of this financial strategy are all fundamental to your success with the infinite banking concept.

And that's it. If you have any questions, please leave them in the comment section below. Thank you for being here. Until next time, have a blessed and inspirational day.

HOW TO START TAKING CONTROL OF YOUR FINANCES BY MAXIMIZING YOUR CASH FLOW AND PROTECTING YOUR ASSETS

1. Schedule Your Free Clarity Call

2. Create a Free Customized Plan

3. Get Guide to Financial Success

GET YOUR FREE COPY TO STOP USING OUTDATED RETIREMENT STRATEGIES

Cash Flow Hacking teaches you to:

Protect Your Investments

Thrive in bad markets

Reach financial freedom faster

ARE YOU LOOKING FOR:

Cash Flow Hacking teaches you to:

Security to protect your money

Increased cash flow and lifestyle

Inflation protection

Financial certainty in all economic environments

A reduction in taxes

Safe and fast access to your money with no penalties

WHO IS THIS PROGRAM FOR?

People looking for an alternative

Are you looking for alternatives to Wall Street’s “buy and hold” strategy that takes 40 years with uncertain results? Our Cash Flow Hacking strategies provide you the building blocks to get started on the right foot

Passionate Entrepreneurs

Are you looking for a financial strategy that will take your best assets (you and your businesses) and multiply their potential? Our Cash Flow hacking strategies will teach you how to invest for the future without sacrificing building your business

Real Estate

Investors

Are you a real estate investor who is burned out from being a landlord or playing the fix-and-flip game? Our Cash Flow Hacking strategies will provide you with the system to create predictable wealth AND give you the freedom you are looking for.

YOU DESERVE PEACE OF MIND AND A PLAN THAT WILL PROTECT YOUR FAMILY AND GROW YOUR WEALTH

Today you need to be more savvy than ever if you try to go at it alone.

Losing money to inflation, taxes, and just poor investment strategies is leaving you frustrated, feeling out of control and not knowing where to turn. To add to the problem, the market is flooded with advisors who have outdated advice that does not place your best interests first, but instead focuses on charging you a fee that creates guaranteed cash flow for them.

NOT YOU

We believe this is wrong and that your security and best interests should be placed first. We believe you should be in a position where you control your money, your money doesn't control you. We understand because we talk with hardworking people everyday that are losing money in the markets based on old information and feel like they are guessing at the best course of action.

We created the Cash Flow Hacking plan to help you have security and control of your money to take advantage of life's opportunities because you deserve peace of mind with your wealth. The old way of planning for retirement of… Go to school Get a job & save as much as you can in your 401k and mutual funds...is broken.

You have been lied to. Think about it, where else in life does someone tell you that the most certain way to achieve your desired result is to take on more risk? The math just doesn't work, and the results are showing in our country and world. Did you know that 90% of millionaires in the United States have 1 asset in common?

Hint: it's not stocks or mutual funds (and no...it's not crypto) How much sense does it make for you to work hard, save money, reduce your current lifestyle (because that's what you are doing when you save for the future - taking money you could use on lifestyle today and delaying gratification to a future unknown time), and hope that whatever you are doing will work three to four decades from now? If you're thinking, "not much sense at all…", you are in the right place.

With over 50 years of experience on our team, we have worked with thousands of individuals and families to achieve financial freedom faster and with more predictability by helping them invest for Cash Flow.

How does the Cash Flow Hacking Plan work? 1. Take the Cash Flow Hacking Challenge 2. Complete the LIFE180 X-Ray and determine what your Freedom Number is 3. Work with a Cash Flow Hacking expert to provide you a customized plan

The customized Cash Flow Hacking plan will give you clarity on where you are now, where you want to go (and in what time frame), and what you need to do to get there predictably.

We value and commit to you: We believe you deserve the best financial education and guidance We believe financial decisions should not be rushed but be well thought out with a plan We believe you should be in control of your money We believe we earn your trust through time, education, and proper due diligence Without a proper plan and guidance, your money can be lost to taxes, inflation, and bad investments You deserve more with the most up-to-date strategies to mitigate your risk, control your money, and earn stable returns regardless of the market Schedule a call here to attain your LIFE180 Financial X-Ray now or get started with the Cash Flow Hacking Challenge for free.

I am interested in...