Why Traditional

Finance Fails?

Why LIFE180

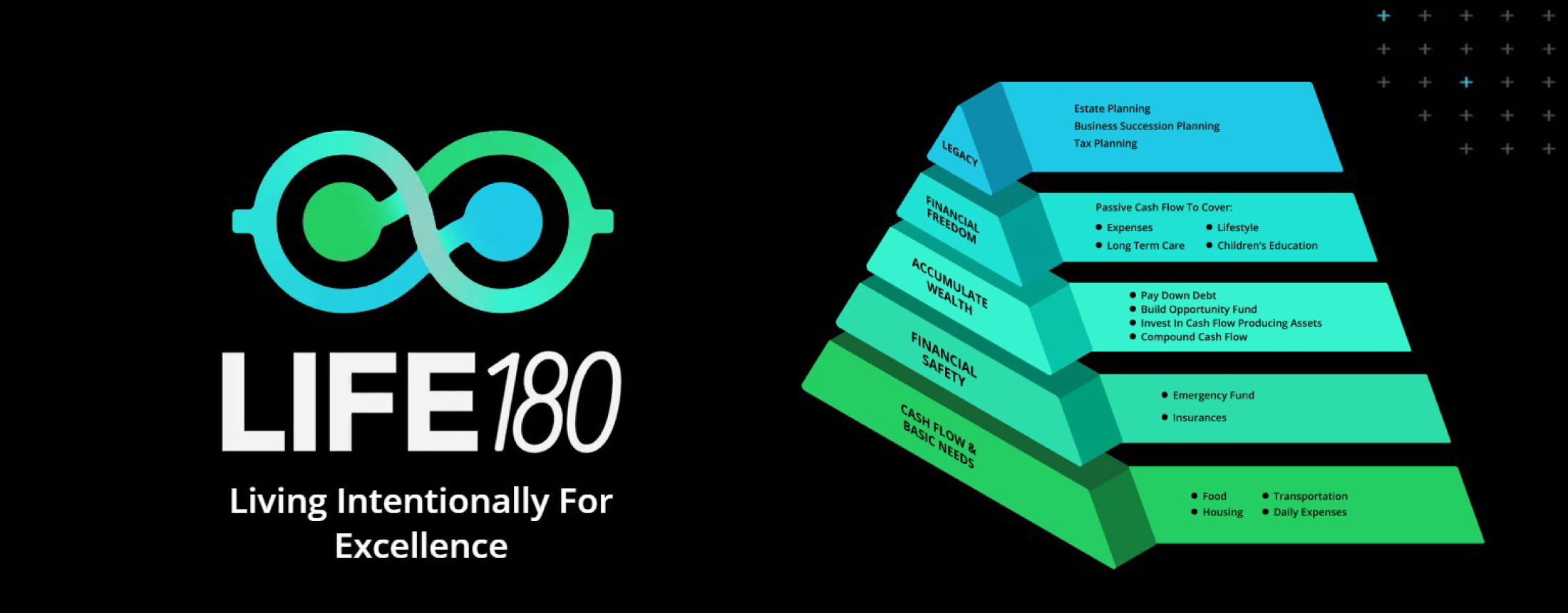

The reason why most financial plans fail is because they

lack education, structure, and alignment.

At LIFE180 we ensure financial strategies are in full

alignment to achieve their freedom.

Your Path to A

Purpose-Driven Future

Alignment

Our team crafts a Cash Flow Hacking Plan to align your finances with your values, accelerating your journey to financial independence.

Design

Build a designe for tax-deferred growth, liquidity, and stability.

Learn How to Transform

Your Finances

Discover the power of Cash Flow Hacking and whole life insurance with our top educational videos. From debunking financial myths to practical wealth-building tips, these videos from LIFE180’s YouTube channel will inspire you to take control.

Infinite Banking Simplified | Explain the IBC to a 10 Year Old

Infinite Banking is made more complicated than it needs to be.

How To Use Whole Life Insurance To Invest For Cash Flow

Chris Kirkpatrick shows a whole life illustration using policy loans to buy cash flow real estate.

Can You REALLY Make Money With Your Car Using Infinite Banking

Many people who are proponents of Infinite Banking will tell you that the benefit of infinite banking is that you can make money on every car you ever buy.

STOP Wasting Money on Buy Term and Invest The Difference

In this video, Chris interviews PHD of Retirement Income Planning, Tom Wall, the author of Permission to Spend, and they discuss where the buy term and invest the difference strategy works, and where it is fatally flawed.

IUL vs Whole Life Insurance EXPLAINED in 30 Minutes!

Most life insurance sales are made by showing illustrations that are unrealistic and misunderstood.

6 Lies Agents Use To Sell Indexed Universal Life Insurance in 2024

In this 2024 version of the lies agents use to sell IUL, Chris Kirkpatrick goes into more detail on why you should use extreme caution before purchasing an IUL.

Align Your Money,

Live Intentionally

At LIFE180, money is a tool for faith, family, fitness, and freedom. Our values Be Free, Be Authentic, Be Bold drive us to reject Wall Street’s risky models. We’re on a mission to raise consciousness around money, empowering entrepreneurs, real estate investors, and families with low-risk, purpose-driven strategies.

Join our movement to protect 1,000,000 lives and counting.

Testimonials

Real Stories,

Real Freedom

Our clients from investors to families show that aligning

money with values creates lasting results. With LIFE180,

you’re building a legacy of purpose.

Get Clear. Get Aligned. Take Control

Clarity creates confidence. Let’s cut through the noise, align your money with your values, and design a financial path you can actually trust.

Contacts

Address: Chandler, AZ

Sign me up!

Make smarter decisions:

Stay informed with the latest financial insights from our experts.

Copyright © 2025 LIFE180 All Rights Reserved